In our first article: "What is DAC7", we explained what DAC7 actually entails and we also handled "Who needs DAC7". If you haven't read the previous two articles, we would recommend to do so, to fully understand the ins and outs of DAC7. DAC7 stands for Directive on Administrative Co-operation in the field of Taxation.

If you have read the previous articles, you know what DAC7 is, however how do you actually set up a DAC7 reporting? This is the final and crucial step, understanding how reporting actually works and what digital platforms must do to stay compliant.

What Seller Information Must Be Collected

To meet DAC7 requirements, platforms need to gather and maintain detailed seller information. This isn’t just basic registration data, it's a complete profile that tax authorities can rely on.

Identification data includes:

- For individuals: full name, address, date of birth, TIN (Tax Identification Number)

- For entities: legal name, business registration number, TIN, and details of any EU permanent establishment

But collecting isn’t enough. All this data must be verified. TINs and VAT numbers need to be checked via EU search engines like VIES (VAT Information Exchange System), while addresses must be validated with official documents such as IDs, utility bills, or bank statements.

Collecting and verifying this data may sound straightforward, but for platforms managing hundreds or thousands of sellers, it quickly becomes a major operational task. Without automated checks, errors slip through and multiply when it’s time to report.

Financial Data and Transactions

Beyond identification, DAC7 reporting covers the seller’s financial activity on the platform.

Platforms must track and report:

- Gross payments made to sellers (before fees/commissions)

- The total number of transactions in the reporting period

- All fees, commissions, or taxes withheld

Some categories require extra detail:

- Property rentals: full address and number of rental days

- Transport rentals: vehicle identification and rental periods

This information needs to be prepared on a quarterly basis so it can feed into the annual report.

These requirements mean platforms need systems that can not only process payments, but also categorise and structure data in a way tax authorities can accept. It’s not just accounting it’s also compliance-grade record keeping.

Reporting Frequency and Format

The reporting cycle under DAC7 works like this:

- Quarterly: platforms must keep accurate records and be able to aggregate data every three months

- Annually: a full report is submitted to the relevant EU tax authority by 31 January, covering the previous calendar year

Reports must be filed electronically in XML format, using the schema provided by the chosen member state. That member state will then share the data with other EU tax authorities.

This dual requirement, quarterly accuracy feeding into an annual XML report, means platforms need to treat DAC7 reporting as an ongoing process, not a once-a-year exercise.

“DAC7 reporting isn’t a once-a-year task — it’s an ongoing process of collecting, verifying, and monitoring seller data.”

Ongoing Monitoring

Compliance doesn’t end with onboarding. Platforms need to keep seller data up to date and monitor whether sellers cross reporting thresholds (€2,000 income or 30 transactions per year).

That means:

- Updating records if a seller changes address or tax residency

- Renewing expired documents

- Tracking income and transaction volumes in real time

Without ongoing monitoring, platforms risk submitting incomplete or incorrect reports which can lead to hefty penalties.

The Challenges

For many digital marketplaces, DAC7 compliance is not a one-off task but an ongoing operational challenge:

- Data is often fragmented across multiple systems (CRM, PSPs, spreadsheets)

- Each EU country may have slightly different XML schema requirements

- Manual collection and verification create onboarding delays

- Seller churn increases if compliance steps aren’t smooth

Seller profiles change, documents expire, and thresholds are crossed. Without continuous monitoring, platforms risk falling out of compliance between reporting cycles.

“Without automation, platforms spend more time chasing data than growing their business.”

Turning Burden into Advantage

While DAC7 introduces complexity, it also presents an opportunity. Platforms that handle onboarding and reporting efficiently can:

- Build trust with sellers and regulators

- Reduce manual overhead and errors

- Scale into new EU markets with confidence

- Create a smoother onboarding experience that sets them apart from competitors

In other words, the same processes that feels like extra work — >collecting, verifying, reporting —> can be reframed as tools for better onboarding, stronger trust, and smoother growth.

How Technology Helps

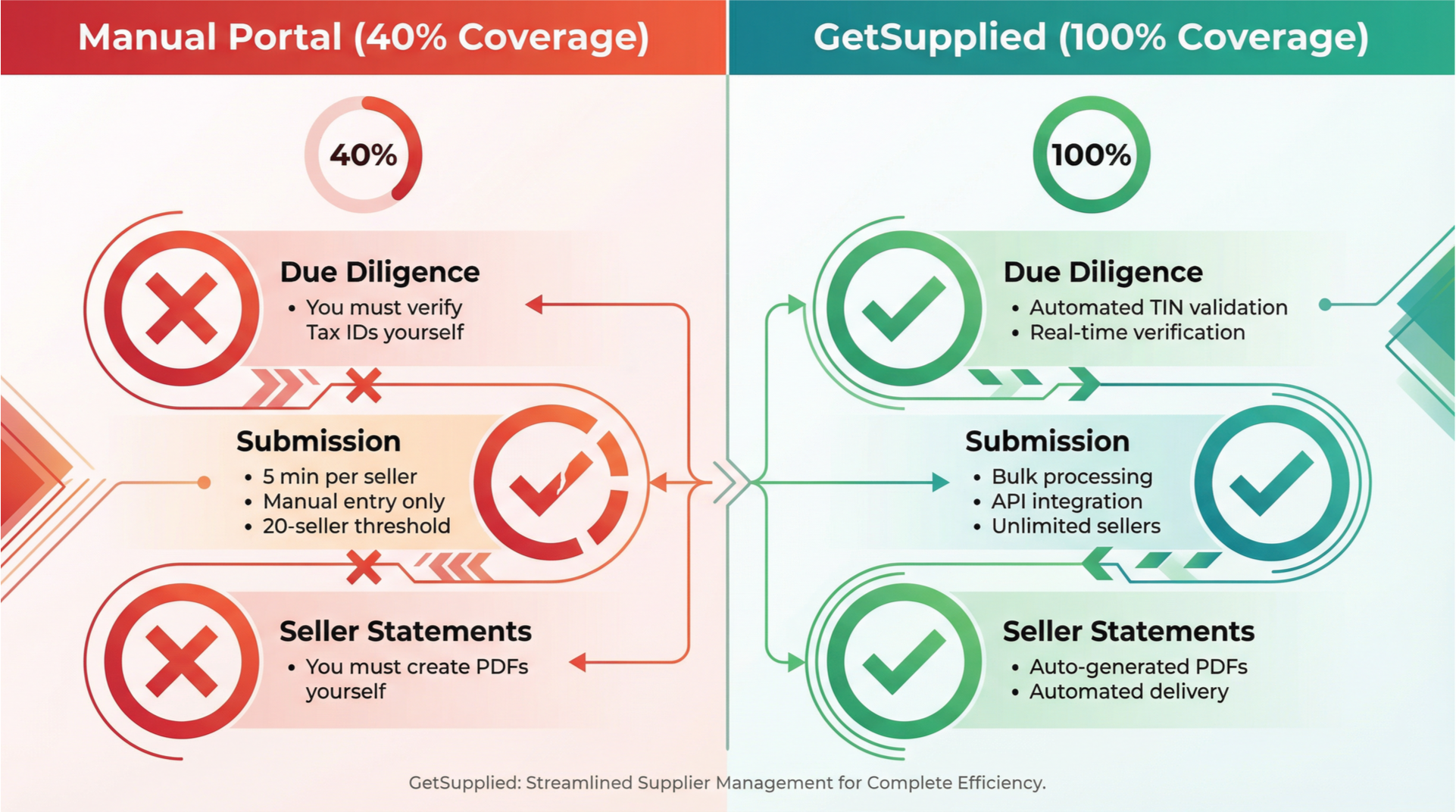

Modern compliance tools, like Supplied, automate much of this process:

- Real-time validation of TINs and VAT numbers

- Automated document checks during onboarding

- Transaction monitoring and threshold tracking

- One-click generation of XML reports in the right format

With automation, platforms can transform DAC7 reporting from a costly burden into a seamless part of daily operations.

By embedding these capabilities directly into their platform operations, businesses remove the friction of manual compliance and turn DAC7 into a background process that simply runs.

“The same processes that feel like a burden — onboarding, verification, reporting — can actually become growth levers when done right.”

Conclusion

DAC7 isn’t just about collecting data, it’s also about building robust processes that keep platforms compliant year after year. By understanding what needs to be collected, how it must be verified, and when it must be reported, platforms can turn compliance into an advantage rather than a risk.