Digital platforms are increasingly vulnerable to identity theft and fraud, facing several critical challenges:

- Account Takeover: Cybercriminals exploit stolen credentials to access user accounts, leading to unauthorised transactions and data breaches.

- Synthetic Identity Fraud: This involves creating new identities using real and fake information, complicating detection efforts.

- Phishing Scams: Fraudsters trick users into providing sensitive information through deceptive emails or websites.

- Deepfake Technology: Advanced AI tools can create realistic fake identities that bypass traditional verification methods.

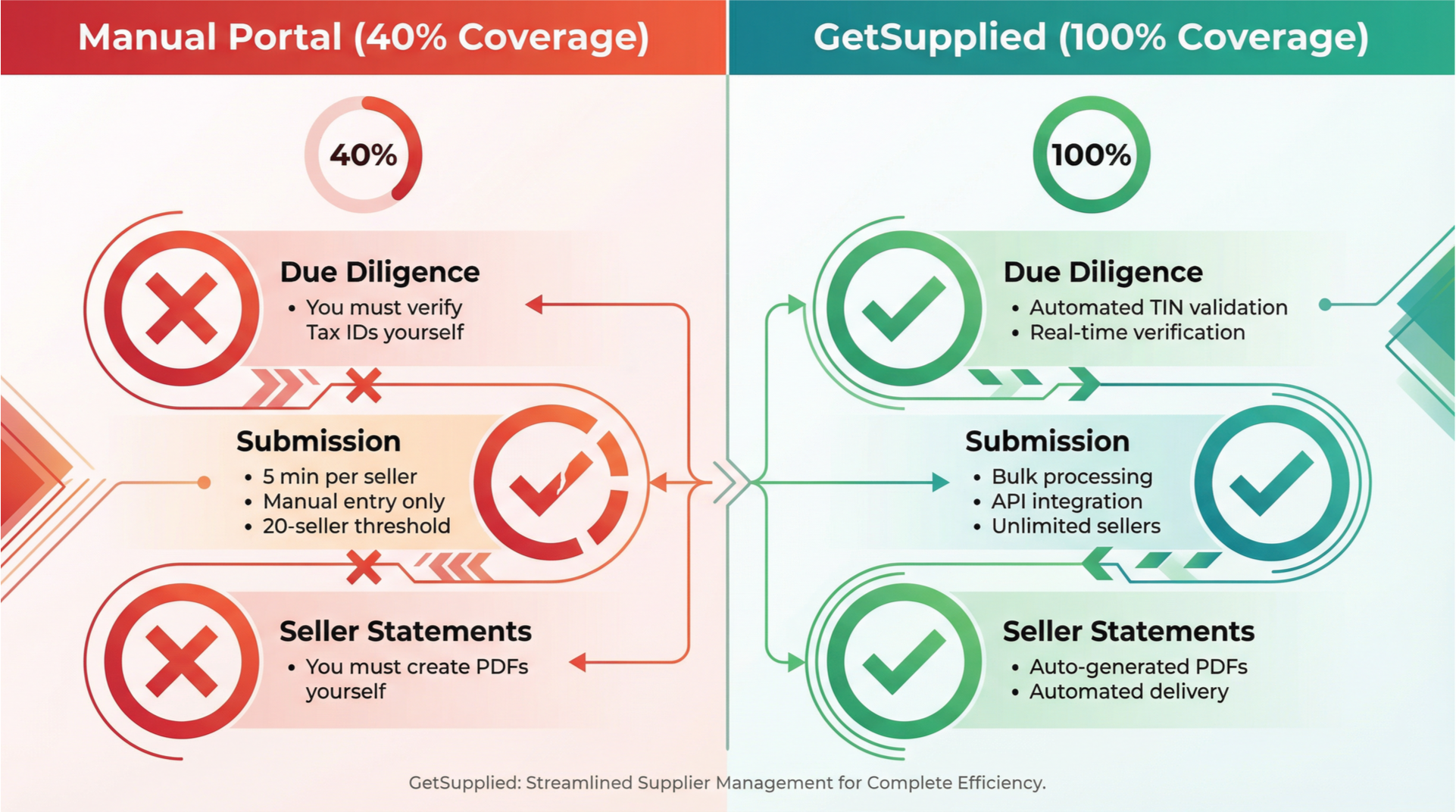

- Regulatory Compliance: Adhering to KYC (Know Your Customer), AML (Anti-Money Laundering), and Tax Fraud (for example, DAC7) regulations are increasingly complex and costly for businesses.

Supplied's AI-assisted KYC and KYB automated compliance services offer robust solutions to these issues. AI Agents automate the collection and verification of customer and business information, greatly reducing the manual workload of traditional methods. This automation efficiently manages large volumes of financial transactions and data, ensuring compliance with regulations while minimising human error.

By leveraging advanced machine learning algorithms, Supplied enhances fraud detection accuracy, quickly identifies suspicious activities, and automates the verification process. This not only reduces operational costs but also improves customer trust by ensuring a seamless onboarding experience while maintaining compliance with regulatory standards.

With Supplied, digital platforms can effectively mitigate the risks associated with identity theft and fraud, safeguarding their operations and customer data.

Book a demo today and we’ll walk you through how you could save time and money while reducing business risk.

.avif)